Our Firm

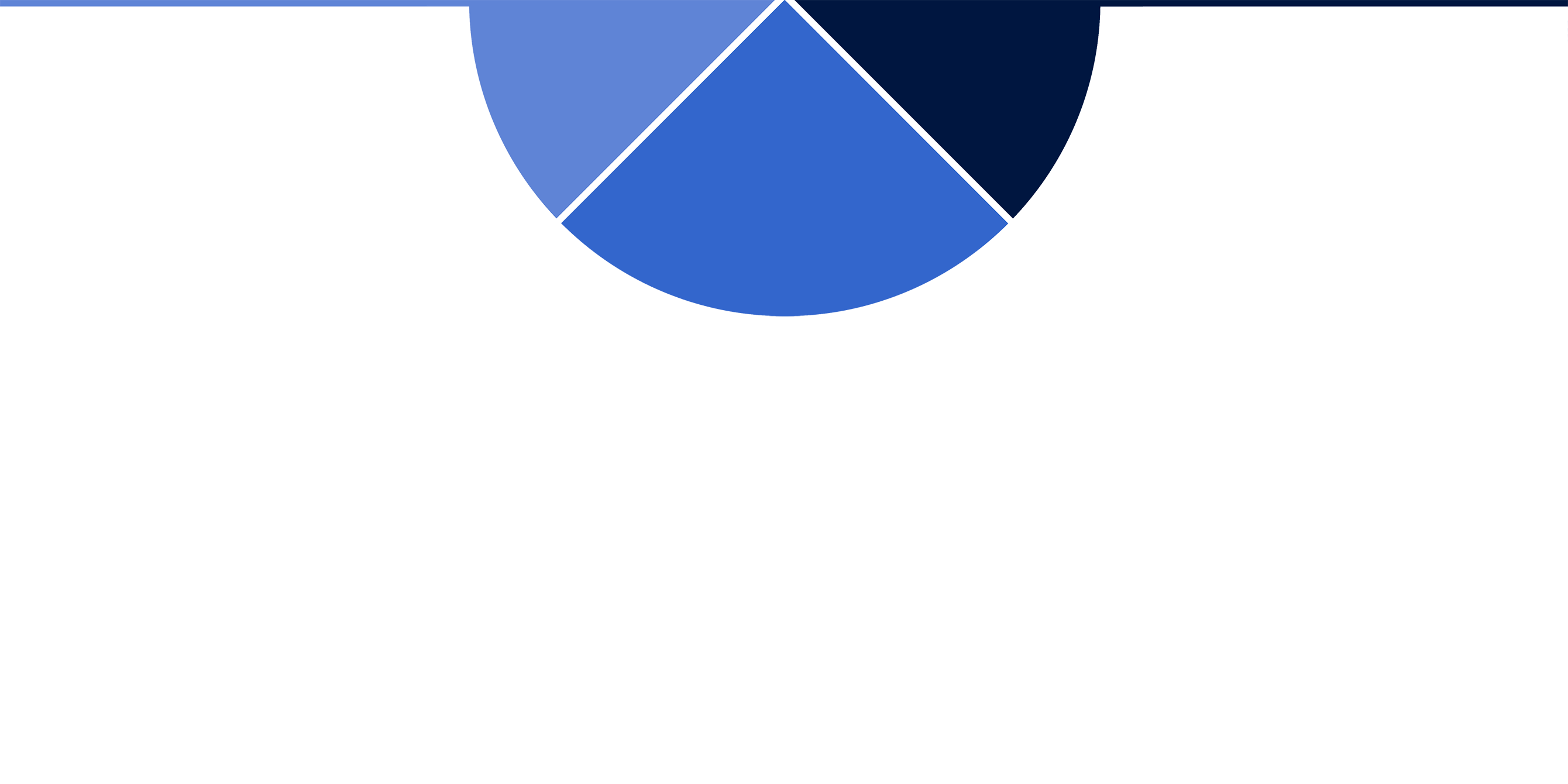

Leeds Equity Partners is a family of funds that invest exclusively in the Knowledge Industries. Founded in 1993, Leeds Equity Partners has managed over $4.8 billion of capital across a broad spectrum of companies within the Knowledge Industries.

Leeds Equity Partners has been a leading investor in the Knowledge Industries for over 25 years and with a strategy to invest in middle-market private equity opportunities primarily in North America.

Leeds Equity Partners has a relationship with its sister fund Leeds Illuminate, whose team has been investors and operators in this space for over 40 years with a strategy to invest in growth stage companies in education and workforce development and access primarily in North America.

To-date, Leeds Equity Partners has invested seven private equity funds. Our investors include many leading institutions, including endowments, foundations, insurance companies, public and private pension funds, family offices and individuals.

Domain Expertise

Our 25-year exclusive sector focus enables us to apply unique strategic insights throughout the investment process and over the course of our partnerships.

- 25-years of industry expertise

- Shared ecosystem of portfolio companies

- Active Board of Advisors

- Vast network of industry executives

- Unmatched business assessment capabilities

- Greater investment conviction, speed of execution and certainty of close

- Viewed as “strategic capital”

- Track record of partnership with founders and management teams

- Strategic guidance

- New customers and key relationships

- New market opportunities and solutions

- Strategic acquisitions

- Best practices from across the portfolio

- Greater product efficacy driving higher customer ROI

- Increased innovation

- Entrenched as a thought leader

- Accelerated company growth

- Larger scale

- 25-years of industry expertise

- Shared ecosystem of portfolio companies

- Active Board of Advisors

- Vast network of industry executives

- Unmatched business assessment capabilities

- Greater investment conviction, speed of execution and certainty of close

- Viewed as “strategic capital”

- Track record of partnership with founders and management teams

- Strategic guidance

- New customers and key relationships

- New market opportunities and solutions

- Strategic acquisitions

- Best practices from across the portfolio

- Greater product efficacy driving higher customer ROI

- Increased innovation

- Entrenched as a thought leader

- Accelerated company growth

- Larger scale

Value-Added Resources

We leverage our value added resources to assist management teams in developing and executing strategic growth objectives.

Investment Criteria

We provide patient capital customized for each opportunity in order to meet the needs of management and current shareholders. Our goal is always to partner with management to create aligned interests among all stakeholders.

Control investments

Select structured minority investments

Leveraged buyouts

Buy-and-builds

Founder transitions

Corporate carve-outs

Public to private

Companies, including with add-on acquisitions, with the capacity to utilize $40M plus of equity capital

Partner company add-on acquisitions and buy-and-builds - no minimum size